In this article, I explain my view on the gold economy and give you my answer to the question does the gold price rise during the world economic recession.

Just a little clarification, I am writing here about gold in particular. Even though this can relate to other precious metals and valuables, that is not the focus. To find more articles about business, you can explore these articles on this website.

Table of Contents

Short answer

Straight up, I can give you a short answer that, yes, the price of gold usually goes up during recessions. But, this is not my definitive ‘yes’. There are many things that I take into consideration. Look at the chapters below to see how I break down this topic so you can navigate faster.

Why prices change

It is very intuitive and easy to notice that prices for stuff change because of supply and demand on the available market. Gold is available to all for trade, therefore, we are looking at the global market. But, not all people have the same amount and are selling or buying at the same rate.

Why are people buying stuff? Because they need to or they are just investing (hoping for gain as demand increases).

And why are people selling? Simply put, people are selling because they have the actual need or if they are scared that their stuff will become useless. Not in all cases but in majority that influences the market.

Global currency

Countries around the world have their own economy and their government control all of the internal markets. To make sure that goods and services are equally priced we need worldwide anchor value.

Think of gold as a unique global currency. That means that with gold people don’t have to depend on any government. And during recessions trust in government to manage savings drops.

Gold price over time

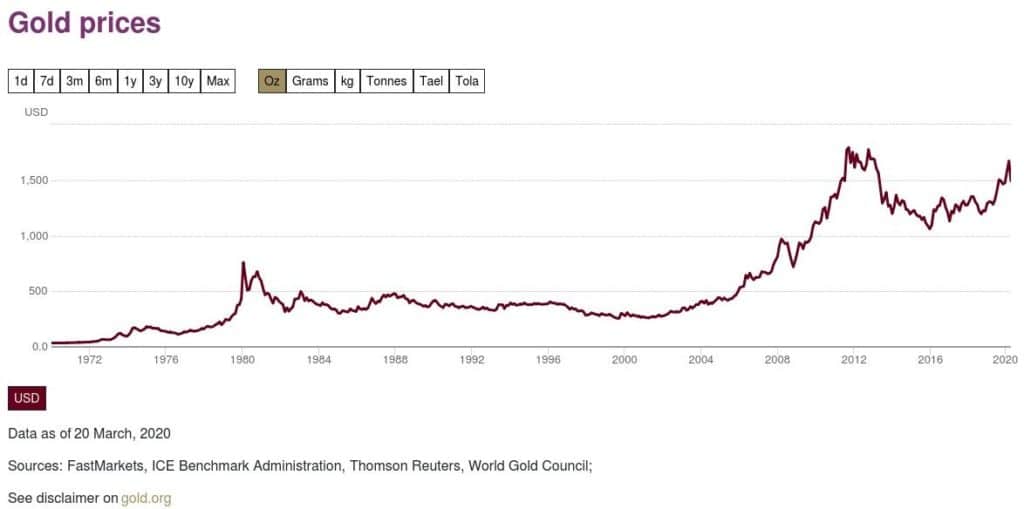

When trying to find a pattern for something that often happens in the world economy I can only look in the past market behavior. The gold has been around for a very long time. I will not write about the whole history here. Let’s look at the 20th and 21st centuries only.

Here is where you can see the continuous graph of gold price.

Gold price during the previous recession

From the graph above you can notice a huge rise in the gold price during the 2008 global recession. The increased price did not drop to the level before the financial crisis. This is largely because people fear the loss and big holders decided to keep as much as possible.

My predictions

Here are a few important things I look for when predicting price fluctuations.

Firstly, I look at the most recent recession period (not just for big world economic recessions but any).

Secondly, I compare the buying and selling amount and frequency to the most recent stable price period.

From the world gold price graph we see that there are two big spikes. After the spike, the price leveled again but on a higher level. After a big global recession price would likely level on much higher levels than after a smaller (shorter) recession period.

Simply put, predicting how big of an impact will the next recession have on a global market (and how long it will last) can provide some rough estimates on what the price of gold might be.

Useful tools

Over time I was using many tools for finance tracking, calculators, planners and so on. Here are some of those things that I find useful and would recommend checking out.

When looking for the current gold price I usually go to goldprice.org web site.

Here are some calculators from the same site that you can use https://goldprice.org/Calculators/Gold-Price-Calculators.html

Feel free to share this post on social media and leave your comments below.